I can't put my head in the sand about this one...

Important info for those in the UK who offer paid subscriptions here on Substack

Hi all,

This is a tricky post to write.

What I feel is;

…knowing about tax is often for the privileged. This isn’t the time to get on my soap box about the disparity in wealth and knowledge but as someone who has experienced a sharp increase in earnings over this last couple of years I have many thoughts.

For a lot of us, tax and tax bills can be/ has been a source of stress and anxiety and we try hard to ‘get it right’. Tax is part of business and running a paid for subscription based newsletter here on Substack is both a business and an income stream.

It’s not glamorous or fun to roll your sleeves up and sort this stuff yourself but one thing I’ve learnt to be true it that it is EMPOWERING when you do. Oh and it’s all ok.

✨

So here we are building newsletter subscription businesses

IMPORTANT - I’m not an accountant or a tax expert and do not have professional training in this area so I cannot advise you.

BUT I need to let you know that it’s important you think about the way you deliver your newsletter to paid subscribers here.

In the UK, “automated digital products” are liable for tax paid by us (the creator) at the point of origin of the customer.

This is in addition to your self assessment tax return due at the end of January each year.

If you’re in the UK and selling to Europe there is a liability you have to pay tax (VAT) at the country of origin for the customer as soon as you make one sale. (Yes even if you’re not at the VAT threshold in the UK (earning £90k+).

If you sell an automated digital product to a country in Europe without a live human interaction at the point of sale, you are liable to pay tax on the income in the country of origin of the customer. Some ‘marketplace’ platforms integrate this liability and pay it for you as part of the fee they charge1, Substack do not.

✨

To check if you’ve exceeded the threshold for tax in any country

If you go to your Stripe dashboard

On the menu bottom left…

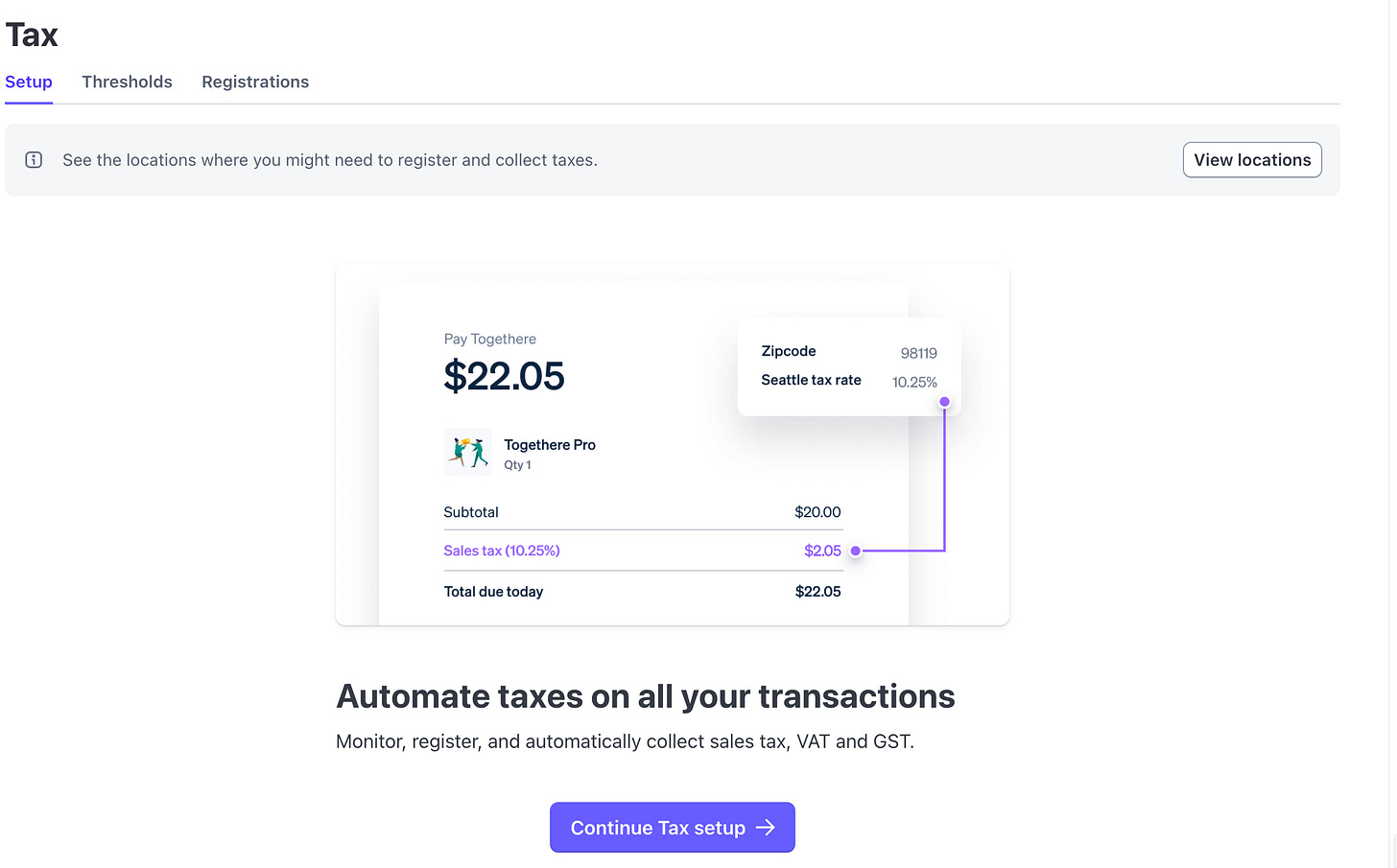

On this page you can see your income per country and the limit for ‘selling digital products’ before you are liable to pay tax. As you can see, just one transaction in Europe means you are liable to pay tax in that country. It’s worth clocking the other limits too so you understand your liabilities. Obviously Stripe do not understand the nuances of how we deliver here on Substack they are simply flagging it for us as a sale.

✨

Substack’s article’s on this topic;

Government resources

What is classed as live human interaction?

To be clear, based on the guidance I’ve received, if you write here, sending an automated welcome email and not further engaging your ‘paying customers’ isn’t enough to warrant ‘live interaction’ and you are selling an automated digital product. I asked Substack but they understandably aren’t able to comment or advise on personal tax.

What I do here…. ;

I drop every subscriber who pays a dm (human interaction)

I host two live classes a month (human interaction)

I host regular chats and threads (human interaction)

What you should do…

If you do have an accountant, flag this with them. Accountants are careful with ‘grey areas’ like this and can advise and reassure you.

If you don’t have an accountant then talk to your colleagues, use the resources above. If you’re a paid member you can use my private chat space and chat there.

Work out what you want to do, what’s right for you with the capacity you have.

You can turn on stripe tax to calculate tax for you so you understand what you’re liable to pay. (We are looking at Stripe dashboards in our next members call (tomorrow at 2pm) Here’s the link.

If you have to file a VAT return yourself or pay an accountant to do it then pay the tax which I’m told can be done in one payment in one European country and distributed to them all. The VAT return needs to be done monthly as far as I understand.

Ok, that’s done, back to joyful, sustainable growth on Substack!

You coming? It will be ok, I promise!

Claire

✨

A resource that may help;

PS - I have been researching this topic for a month, I’ve spoken to two accountants, colleagues who are VAT registered, colleagues who aren’t. This is all the info and understanding I have. I’m obviously nervous to put this out but hope that you can do your own research now I’ve flagged it. Members, feel free to use chat to talk about it but I can’t say more than this.

PPS - I listed to this song on repeat writing this email, you’re welcome.

(Etsy, Patreon are examples)